Drug Discovery: Old realities meet with new modalities

The research landscape is becoming more and more complex and software solutions

need to keep the pace to continue to support scientists across modalities

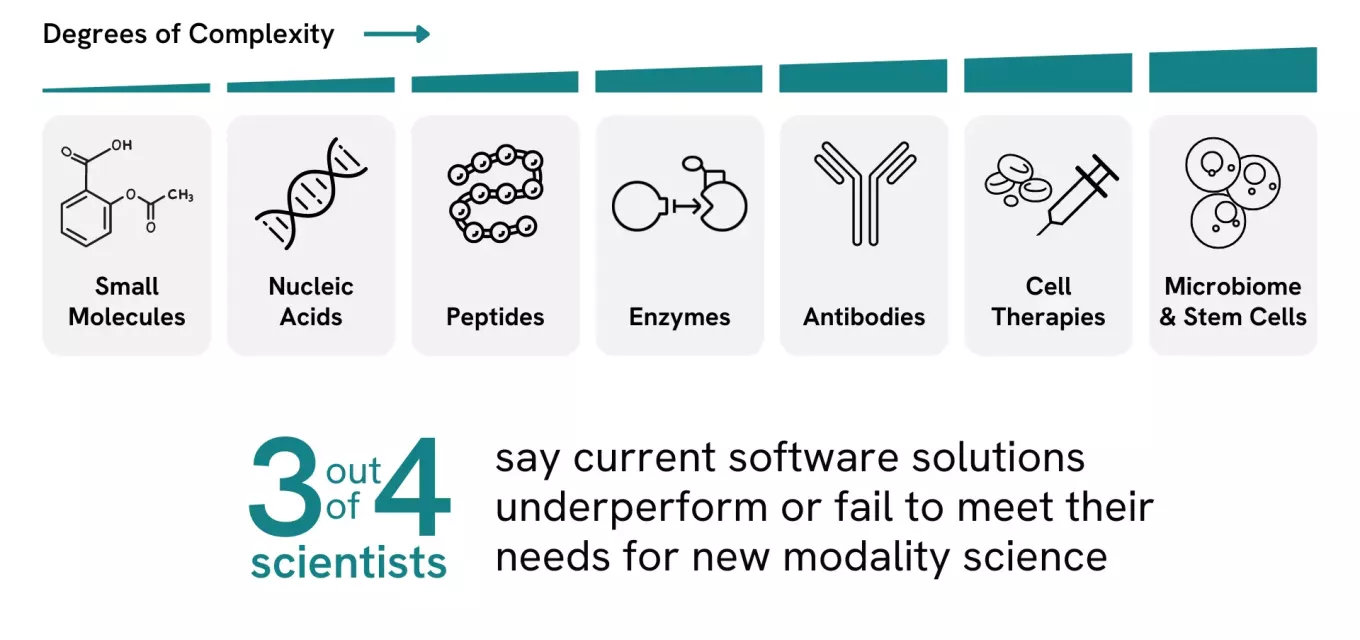

After each scientific breakthrough, new ideas often leap across domains. Today, traditional small-molecule research is paired with a wide array of larger drug modalities, from monoclonal antibodies to mRNA — creating new opportunities and posing complex challenges.

While small-molecule drug discovery continues to deliver amazing successes, new modalities bring diversity and fresh ways of thinking that dramatically expand our ability to meet unresolved treatment needs. In fact, both small-molecule research and new modalities are proving to be remarkably fruitful, in some recent cases powered by some remarkable AI-driven research.

In the five years to 2022, the US FDA approved 182 small-molecule drugs out of 293 new approvals1 (about 60:40), whereas the top-selling drugs in 2023 were split 40:60 in the other direction. In the ten years to 2024, global investment in drug discovery has approximately doubled to around $71 billion, and investment in monoclonal antibodies has approximately tripled to perhaps $10 billion.2

In short, new modalities are opening up novel, safer, better ways to address unmet diseases, including antibodies, protein peptides, cell therapy, gene therapy, vaccines, and RNA therapeutics. These technologies are changing the way we think about the mechanisms of action in the body, and even what we think of as potentially treatable. This new modality research has also had an impact on the reimagining of small molecules. For example, antibody-drug conjugates (ADCs) show the massive potential for synergy — and to-date the FDA has approved just 15 ADCs3 in this potentially huge new category. More to the point, those 13 drugs offer cancer treatment possibilities to tens of thousands of people.

ADCs are a great example of how a newer modality springs to life, and how it spans boundaries: a known payload of a well-studied, small molecule combined with a novel technology. What were separate camps are now merging into a unified field. Divisions between chemistry, biologics and gene therapies are vanishing, and the intersections of what were previously considered separate domains offer the most dynamic areas of research. Even where there is a sense within a single modality that the low-hanging fruit has already been picked, the new modalities and combinations of modalities will be essential for tomorrow's drug discovery innovations.

Complex biologics can be painstakingly slow and exceptionally costly to develop, and the resulting therapies are correspondingly expensive, raising significant moral questions about the use of funds and equality of access. However, possibly the most interesting feature of these new modalities is the way they shape our thinking about what is treatable, and where we should or could be looking.

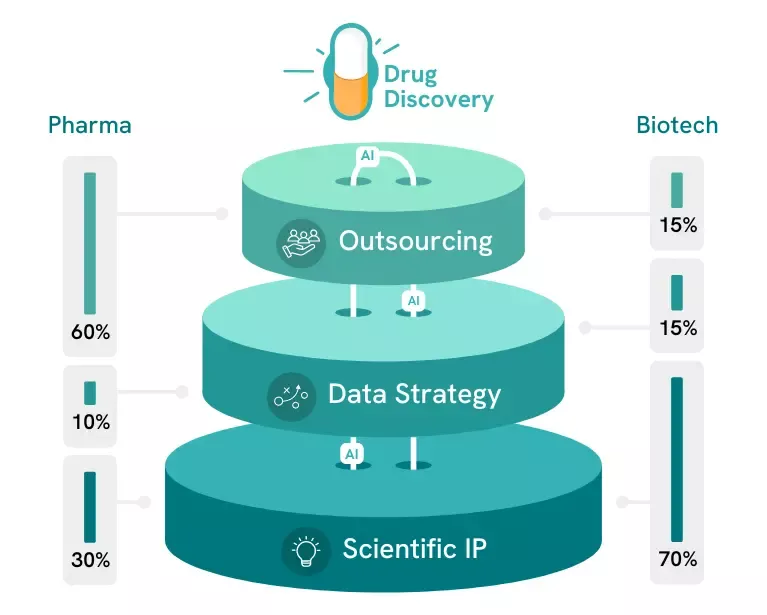

Given the ever-broader landscape of modalities, what is needed to lead successful drug discovery? First and foremost, seizing opportunities for collaboration and cross-fertilization requires a shared language across domains of knowledge and expertise. If you are unable to communicate your discovery in your field to others, then your work may well be trapped. After all, the basic challenge of make, test, screen, decide, applies to all modalities, and particularly for globally diverse teams with units in multiple geographies that cannot meet in person, easy communication over distance is key.

For example, how do you describe the unique modifications of an antibody designed for a novel ADC, or show how it compares to the same base molecule used in another project? This question will work to address the larger database organizational definitions. Once the fundamental question of "what makes an ADC?" is established, then rules can be implemented to denote and identify what is deemed unique and sharing and maintaining the database of these assets can begin. Creating a fit-for-purpose database is easier said than done, and among other things it must house metadata on new modality drugs, align with company definitions, and contain full experimental contexts for easy analysis. There’s no question that integrated digital systems have transformed research productivity, and enabled global collaboration and communication. The danger is that solutions focusing on only one modality can become data and process dead-ends, unable to serve the needs of multi-modality research. We are not suggesting that a multiple-modality approach is always correct for each disease, however, the optimal strategy is to remain open to possible modalities and understand why or which modality could work or may work better to address the patients afflicted with disease. Whether you are working on a new drug target that has yet to be proven or reimagining a better way to address a known disease, making a bet on a modality should be informed by genetic sequence data, the ability to scale up and clear translational endpoints factors that wholistically take R&D, clinical and patient data into account.

In the past, it was common to hear that certain conditions were considered “undruggable” — perhaps the blood/brain barrier prevented drug delivery, or maybe we could not solubilize the chemistry. New modalities show us that there are possibilities out there waiting for us at the juncture of so many fields. Fundamentally, having a digital mechanism to share in a language, data, or even a mindset is essential if these opportunities are to be capitalized on.

A specific example that sheds new light on the crossover between small and large molecule research is exemplified by cyclic peptides or macrocycles, such as Merck's journey developing the macrocyclic peptide MK-0616, an oral PCSK9 inhibitor that targets hypercholesteremia4. Just when we think that larger modalities are the major future way to go, this molecule class could be another key to unlocking “undruggable” targets within drug discovery.

At Revvity Signals, we understand these challenges and frustrations well. Rather than operate isolated software solutions that are built to handle a limited set of modalities, Signals OneTM provides a broad platform and framework that spans across modalities within drug discovery. Taking advantage of a single integrated environment increases your chances of clearer communication and faster drug development within the new world of research.

Are these among the issues you face, or is there something else where the supporting technology is sorely lacking? Maybe AI is more important than analysis, or there are other challenges that soak up valuable research time that are higher priority. Again, drug discovery is hard. Like research itself, no solution is likely to be perfect, and there will be areas for improvement and development. Revvity Signals’ commitment is to the journey, helping you to discover new landscapes, new modalities, and new therapies.

We value your insights and invite you to take part in our poll where you can share your views on the issues and challenges you face and what solutions may resolve them: Share your thoughts!

If you need more information on this topic or any of our solutions please do contact us.

Zev Wisotsky, Ph.D.

Sr. Principal Marketing ManagerZev is a Sr. Principal Marketing Manager for Biologics in the Signals Suite. His scientific training and research background includes neuroscience, biochemistry, molecular biology, and drug discovery. He has spent 7+ years in software in go-to-market teams across industries with a heavy focus on biopharma/biotech R&D.